In 2016, the industry shipped just under 1.5 billion phones. By 2020, that figure had fallen to less than 1.3 billion.

Last year’s figures are not yet available. Early indications are that the 2021 tally will be slightly lower than 2020.

Last year’s figures are not yet available. Early indications are that the 2021 tally will be slightly lower than 2020.

It seems plausible. Yet the underlying five-year trend remains down regardless of short-term considerations.

gentle decline

Phone sales numbers haven’t fallen off a cliff. They show a slight year-over-year decline with the occasional slight quarterly rise.

There are people in the industry who believe the move to 5G will rekindle consumer interest.

It’s possible, but unlikely. There are few new and convenient features that 5G networks have to offer phone buyers. You won’t be able to do anything new with a 5G phone that you can’t do with a 4G phone other than access a previously unavailable part of the frequency spectrum.

This lack of new capabilities is at the heart of the problem.

Saturated market

The telephone market is saturated. There are few new buyers entering the market.

At the same time, there has been less innovation in telephone technology. There is no compelling reason to offer an upgrade. This means people cling to existing models longer.

You upgrade when your existing phone dies or degrades.

IDC suggests that sales will increase by 2025. At that point, total shipments will hit a new high of a fraction over 1.5 billion.

Flat, or at least flat

Even if that’s correct. It can only be considered a flat market. Indeed, IDC indicates that total shipments will increase by less than 2% over a decade.

Apple kicked off the era of modern touchscreen smartphones in 2007 with the release of the first iPhone.

Over the years since then, the company’s share of total unit sales has fallen. At one point, more than seven Android phones were sold for every iPhone.

When it comes to revenue, Apple’s share has always been much higher. And even higher if we look at the profits from the sale of phones. Many of the company’s Android competitors were actually buying market share by selling at cost or even at a loss.

Today, Apple’s unit market share is climbing again as Android rivals exit or disappear.

Apple winner of Huawei’s setbacks

Apple took advantage of Huawei’s setbacks. Sales of the company’s phones have plummeted since the US imposed sanctions two years ago.

most recent overview of the phone market from Canalys says:

“Apple accounted for 22% of global smartphone shipments in Q4 2021, driven by strong demand for the iPhone 13.”

Canalys analyst Sanyam Chaurasia said, “Apple has seen unprecedented iPhone performance in mainland China, with aggressive pricing for its flagship devices, which keeps the value proposition strong.

“Apple’s supply chain is starting to recover, but it was still forced to cut production in the fourth quarter due to shortages of key components and was unable to manufacture enough iPhones to meet the In priority markets, it maintained adequate delivery times, but in some markets its customers had to wait to get their hands on the latest iPhones.

|

Global Smartphone Shipments and Growth |

|||

|

Seller |

Q4 2020 market share |

Q4 2021 market share |

|

|

Apple |

23% |

22% |

|

|

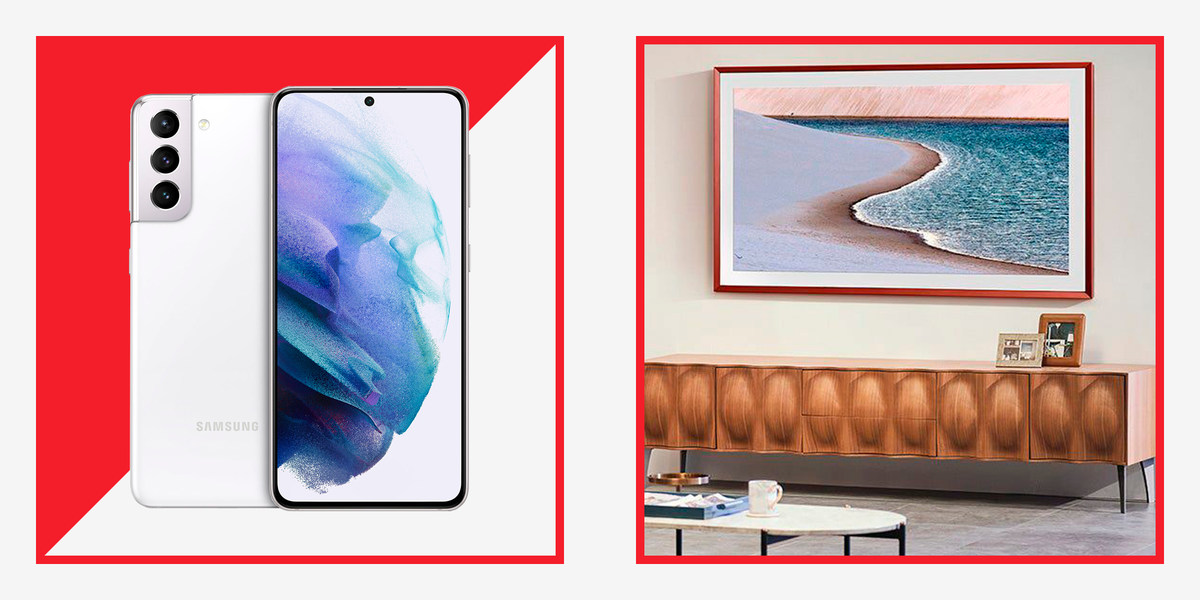

Samsung |

17% |

20% |

|

|

Xiaomi |

12% |

12% |

|

|

Oppo |

ten% |

9% |

|

|

long live |

9% |

8% |

|

|

Preliminary estimates are subject to change upon final release |

|||

Phone sales peaked five years ago was first published on billbennett.co.nz.

© Scoop Media

.jpg)